On the night of Oct 21, the National Food and Strategic Reserves Administration and the Ministry of Finance announced to reserve 500kt of 2020/21 Xinjiang cotton into state warehouses. ZCE overnight cotton futures market did not rise and stepped downward. The state cotton reserves may lead to narrower price spread between domestic and foreign cotton, and ZCE cotton futures market also faces large pressure.

1. State cotton reserves may lead to narrow price spread

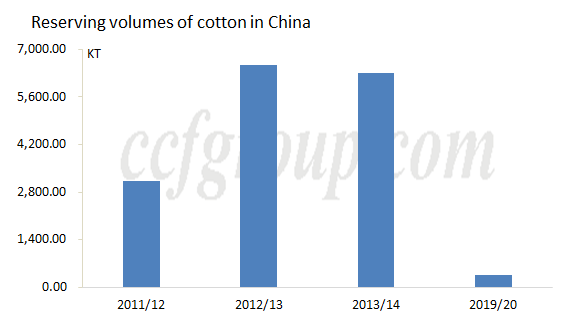

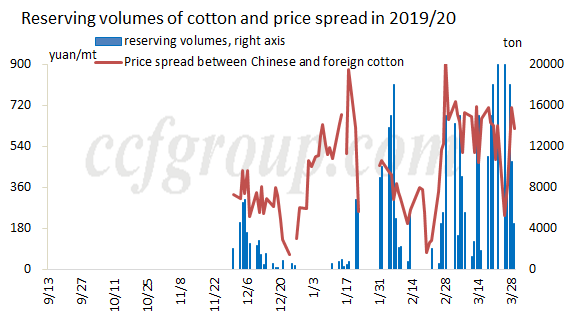

Since 2011, China has implemented four state cotton reserve policies. The reserving volumes reached 3.116 million tons in 2011/12 season, 6.537 million tons in 2012/13 season, 6.308 million tons in 2013/14 season and 372kt in 2019/20 season. During the reserves in 2019/20 season, the reserves required the price spread between domestic and foreign cotton (Price spread of domestic and international cotton=China spot cotton index-international spot cotton index, domestic cotton price=(China Cotton Index+CNcotton)/2, International spot cotton index=Cotlook A Index under 1% tariff), if the price spread exceeded 800yuan/mt for three consecutive working days, the reserves would be suspended, and when it fell back to 800yuan/mt, the reserves would restart. In 2020/21 season, this requirement continues.

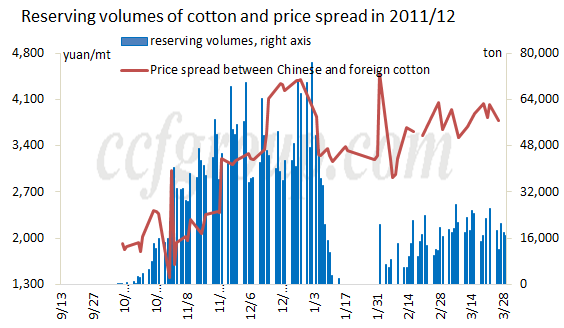

As there is no requirement on price spread in 2011/12, 2012/13 and 2013/14, by comparison, during the reserves in 2011/12 season, the price spread continued to expand, and the reserving volumes were obviously smaller after the Spring Festival holiday.

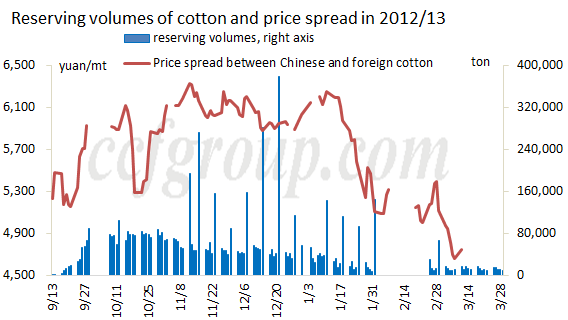

During the reserves in 2012/13 season, the price spread fell down in correction overall, and the reserving volumes experienced more times of sharp increase on daily basis.

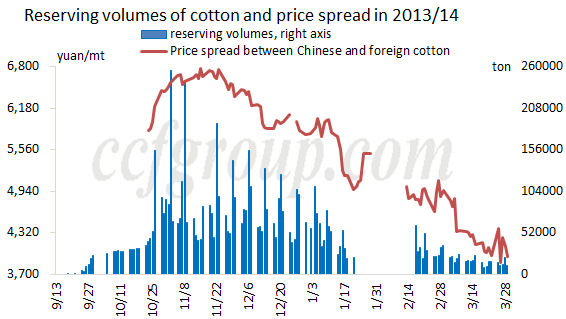

During the reserves in 2013/14 season, price spread continued to decrease, and with the lower Chinese cotton prices, the enthusiasm to reserves weakened.

During the reserves in 2019/20, due to the requirement on price spread and the stronger relation with international cotton price, the price spread was mostly range-bound within 800yuan/mt. In early period of reserves, with higher cotton prices, the enthusiasm to reserves was low, later, with the continual downswing of cotton prices, the enthusiasm warmed up apparently.

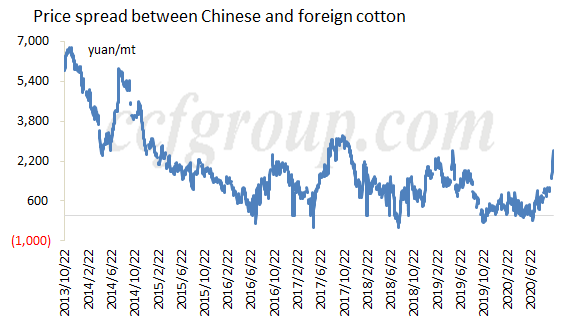

With regard to the price spread since 2013, the price spread has narrowed gradually, and was range-bound since 2016.

By Oct 21, 2020, the price spread has recovered to around 2,368yuan/mt, a relatively high level since 2016, while the price spread is likely to fall down later, partly because the 400kt of sliding-scale duty quotas will be allocated soon, which may ease the tightness of cotton quotas, partly because mills may adjust lower the purchase proportion of Chinese cotton properly due to high Chinese cotton prices and the US ban on Xinjiang cotton. It is heard that many mills purchase nearby shipments of imported cotton at present.

2. ZCE cotton futures market is likely to decrease

After the National Day holiday, the cotton textile industrial chain has risen in general. From the angle of the industry, the active purchase of seed cotton pushes up the cotton costs, and some real demand and speculative demand leads to the supply shortage. But with continual upswing of prices, the downstream demand begins to weaken. The market gradually steps into the slack season after Oct, and the state cotton reserves policy also leads to the decline in cotton futures. Later, there are temporarily no favorable factors to push up the cotton prices, while the market faces large pressure from the intensive arrivals of global cotton, hedging pressure of spot cotton and downstream actual consumption.

In general, the state cotton reserves make market players pay attention to the price spread. The allocation of 400kt of sliding-scale duty quotas may make the price spread narrow. Market supply may increase in short with the intensive arrivals of global cotton and the selling from the traders. With the gradual coming slack season for consumption and the high cotton prices weighing on downstream demand, ZCE cotton futures market faces large pressure. The cotton futures market is easy to decline and hard to rise.