|

|

|

home > Industry News

How will Indian cotton yarn mills evolve after resuming work?

India has entered a 14-day total blockade from March 23. Prime Minister Modi announced that the national blockade will extend to May 3, and some industries can resume work with approval. In early-Apr in northern India, some yarn mills were on production as employees were retaining in the factory. At that time, most of mills in Indian were still shut down. From the second week of April, spinners in Uttar Pradesh, Gujarat, and Punjab can submit applications to the government asking for the start of production. A small number of spinners resumed work with operating rate ranging within 10%-50%, and they mainly focused on fulfilling recent contracts. Despite the fact that some factories were allowed to resume production, production has not been resumed due to the lack of workers and orders. Some factories have reported that after completing domestic sales and a small number of export orders, if there were no more new orders, they may eventually choose to shut down again.

USD prices fall fast

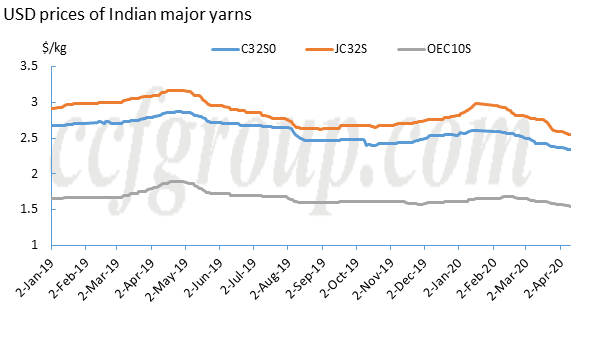

Cotton yarn market was still lackluster with bleak shipments in spite of liberating policy on Indian yarn mills operation. According to the CCFGroup index, the price of Indian forward cotton yarn kept sliding.

It can be seen that the prices of yarns mainly exported to China, such as Indian carded yarn, combed yarn and open-end yarn, have all declined since Feb. Combed 32S has dropped from $2.96/kg to $2.47/kg; carded 32S has dropped from $2.59/kg to $2.29/kg, and OEC10S has fallen from $1.66/kg to $1.52/kg.

Recent profits of Indian yarn mills

Although the spot price of Indian cotton fell from 39,400Rs./maund (about 10,300yuan/mt pre-tax) at the start of Chinese New Year holiday to 37,100Rs./maund (approximately 9,700yuan/mt pre-tax), the decline was far less than cotton yarn prices. Although Indian rupee depreciation has reduced the cost of cotton yarn, profits still kept falling rapidly. Based on the one-month and two-month cotton stocks, spinners suffered losses about 10cents/kg. If the spinners adopt straight cash deal, the cost is basically the same as the spot price.

Spot prices are similar to cargos

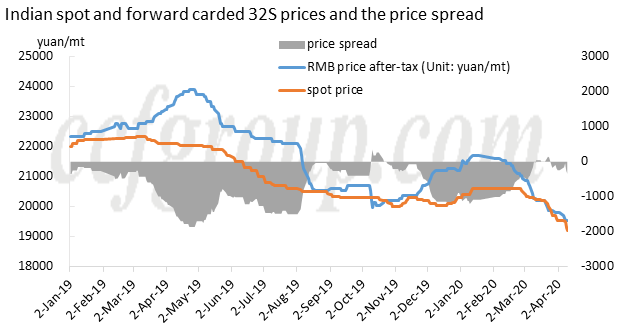

Price of cargos was falling, so did that of spot imported yarn. Indian carded 32S fell to 19,100yuan/mt from 20,600yuan/mt in Feb. Compared with USD price converted into RMB after-tax price, the advantage was not large, failing to stimulate forward yarn orders. Since the outbreak of the epidemic, USD price seesaw rapidly. However, precaution, most of spinners still wait and see.

It can be seen that the prices of yarns mainly exported to China, such as Indian carded yarn, combed yarn and open-end yarn, have all declined since Feb. Combed 32S has dropped from $2.96/kg to $2.47/kg; carded 32S has dropped from $2.59/kg to $2.29/kg, and OEC10S has fallen from $1.66/kg to $1.52/kg.

Recent profits of Indian yarn mills

Although the spot price of Indian cotton fell from 39,400Rs./maund (about 10,300yuan/mt pre-tax) at the start of Chinese New Year holiday to 37,100Rs./maund (approximately 9,700yuan/mt pre-tax), the decline was far less than cotton yarn prices. Although Indian rupee depreciation has reduced the cost of cotton yarn, profits still kept falling rapidly. Based on the one-month and two-month cotton stocks, spinners suffered losses about 10cents/kg. If the spinners adopt straight cash deal, the cost is basically the same as the spot price.

Spot prices are similar to cargos

Price of cargos was falling, so did that of spot imported yarn. Indian carded 32S fell to 19,100yuan/mt from 20,600yuan/mt in Feb. Compared with USD price converted into RMB after-tax price, the advantage was not large, failing to stimulate forward yarn orders. Since the outbreak of the epidemic, USD price seesaw rapidly. However, precaution, most of spinners still wait and see.

Poor downstream orders

Social stock of imported yarn was still at a high level, and shipments were not fast. And operating rate of the downstream fabric mills reached about 30%-40%, much lower than that in same period of last year. Imported yarn mills' willingness to order cargos is unlikely to significantly improve before the fabric mills orders improved, so even if there is sell-off, the transaction is still not very satisfactory.

Poor downstream orders

Social stock of imported yarn was still at a high level, and shipments were not fast. And operating rate of the downstream fabric mills reached about 30%-40%, much lower than that in same period of last year. Imported yarn mills' willingness to order cargos is unlikely to significantly improve before the fabric mills orders improved, so even if there is sell-off, the transaction is still not very satisfactory.

In conclusion, due to current requirements of personnel arrangements and epidemic prevention, it will take some time for the general work resumption in the Indian yarn mills. With the fall in Indian cotton and cotton yarn prices, the theoretical profits were mostly at a loss. As for Indian cotton yarn, there are some price inquiries from China. Even so, due to poor shipments in the spot market, transactions are still limited. In general, the operating rate of Indian yarn mills is gradually recovering, but under the current market conditions, it is more difficult to recover to 100%. After the cotton yarn inventory rises, if the epidemic still fails to improve, the O/R will move down.

In conclusion, due to current requirements of personnel arrangements and epidemic prevention, it will take some time for the general work resumption in the Indian yarn mills. With the fall in Indian cotton and cotton yarn prices, the theoretical profits were mostly at a loss. As for Indian cotton yarn, there are some price inquiries from China. Even so, due to poor shipments in the spot market, transactions are still limited. In general, the operating rate of Indian yarn mills is gradually recovering, but under the current market conditions, it is more difficult to recover to 100%. After the cotton yarn inventory rises, if the epidemic still fails to improve, the O/R will move down.

|

|