|

|

|

home > Industry News

How will spandex market fare amid downward pressure on price

Since the beginning of the third quarter, raw materials for textile garments have been relatively weak. Polyester, cotton and cotton yarn declined significantly, while spandex prices slowly decreased, leading to obvious oversupply pattern of industry. Due to the relatively large new spandex capacity and insufficient orders during off-season, downstream weavers mainly purchased on demand. Spandex market continued to be weak amid intense competition.

| Category |

Chemical fiber |

Cotton |

| Product |

Polyester direct-spun POY |

Polyester direct-spun FDY |

Nylon 6FDY |

Spandex |

Domestic cotton |

Domestic cotton yarn |

Rayon |

| Specification |

150/48 |

Semi-dull 150/96 |

70D/24F |

40D |

3128 |

CY C40S |

CY R30 |

| 2019-8-12 |

7590 |

7565 |

16700 |

29200 |

13110 |

21450 |

15900 |

| 2019-7-1 |

8750 |

8875 |

16150 |

29600 |

14360 |

22050 |

16350 |

| Change (yuan/mt) |

-1160 |

-1310 |

550 |

-400 |

-1250 |

-600 |

-450 |

| Change (%) |

-13% |

-15% |

3% |

-1% |

-9% |

-3% |

-3% |

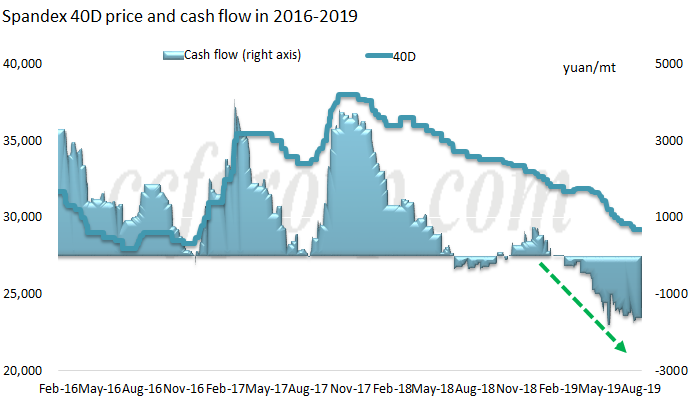

Cash flow: large-scale loss

The downward space for raw materials prices was relatively small, and MMDI prices kept firm after slight rebound. PTMEG was relatively weak and adjusted in a narrow range as downstream buyers tried to talk the prices of new orders down. Coupled with slow demand and oversupply, the spandex prices descended consistently and most spandex plants were at a significant loss, although a few leading enterprises kept meagerly profitable.

According to the performance report issued by Huafon Spandex for the first half of 2019, net profits reached 236-285 million yuan in January-June, 2019, and it was 248 million yuan in the same period of last year, with a year-on-year change of -4.9%-14.9%.

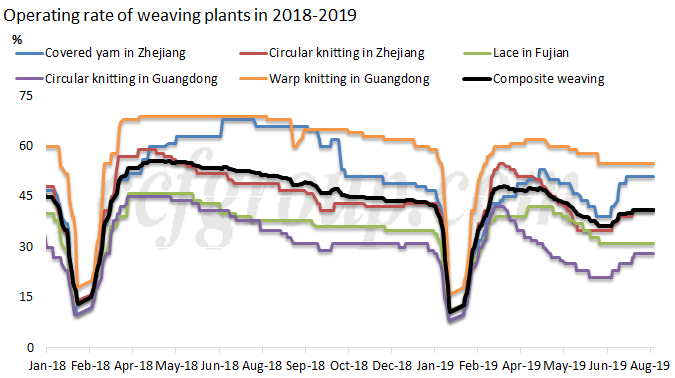

Demand:Flat orders in traditional off-season

Impacted by weak macro and slow demand in traditional off-season, operating rate of downstream weaving plants declined by around 10% year on year. Run rate of covered yarn was at 50-70%, while operating rate of circular knitting in Jiangsu, Zhejiang and Guangdong and lace in Fujian was at 30-40%. Warp knitting ran at 50-60%.

Covered yarn

The market of integrated air covered yarn, conventional covered yarn and cotton core-spun covered yarn were remarkable, but finished goods inventory of covered yarn plants remained high.

Integrated air covered yarn in Shengze, Xiaoshan and Shaoxing consumed spandex for rigid demand considerably, with run rate at around 70%. Purchasing cycle of spandex was low at around 7-15 days.

Conventional covered yarn plants in Zhuji and Yiwu mainly produced regular specifications such as nylon/spandex covered yarn 4070 and 4050, and the orders for socks and lingerie remained small.

Operating rate of cotton core-spun covered yarn in Zhangjiagang rose to 60%, and sales of 70D slightly ascended. Black spandex for small circular knitting in Yiwu was also in severe competition. Though the black spandex output of Xinxiang Chemical Fiber and SheiYungHsin was eliminated, it largely ticked up in Ruian and Shaoxing, Zhejiang. Units in the Northwest were expected to enter the competition in this field.

Circular knitting and lace

The run rate of circular knitting in Jiangsu, Zhejiang and Guangdong was at 30-40% in early August, and the output of thick fabrics with double facer increased, with slightly rebounding demand for 30D and 70D. Single facer jacquard and print fabric had no big change, while several units reduced operating rate as orders in previous stage finished. Operating rate of lace in Changle, Fujian was at above 30% and was still in traditional off-season.

Warp knitting

The run rate of warp knitting in Guangdong and Haining was at 50-60%, and the business was worse than the same period of last year. Warp knitting in Guangdong ran at 50-60%, while the order from the US reduced significantly. The local orders or export order for other destinations were modest. The rigid demand for spandex was considerable in July and early August.

The competition in low-end warp knitting in Haining was extremely intense this year. 1,500 new local low-end warp knitting units were put into production in 2017-2018. In 2019, the volatile polyester market was not conducive to placing orders for downstream, coupled with the changes in style and other factors, so demand weakened. Super soft finished product inventory was high, and price competition was severe, so local low-end warp knitting plants were under great operating pressure, and several plants sold units at fire-sale prices. In addition, the new spandex capacity was mainly for warp knitting and covered yarn, so prices of 40D spandex for low-end warp knitting were obviously lower than spandex for circular knitting.

Market outlook

The downward space for spandex may narrow under the pressure of losses in the third and fourth quarter. Nevertheless, dumping goods such as new products and resources that are stocked for a long term may still be offered with discounts. If the orders increase in traditional peak season, spandex sales are anticipated to rise.

|

|