|

|

|

home > Industry News

Close virgin PSF market shares squeezed by virgin PSF

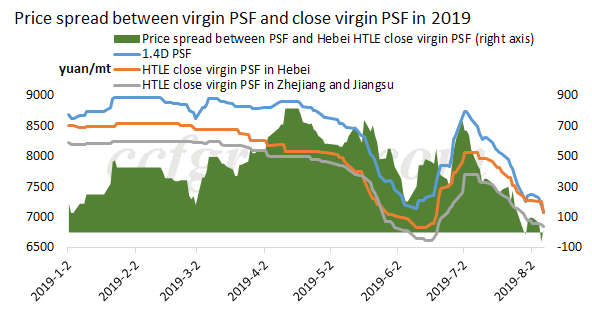

Virgin PSF has been constantly weak since late July, to around 7,000yuan/mt at present, which is close to the quality close virgin PSF or even be lower than the latter one.

Downstream spinning mills witness high product inventory. Close virgin PSF plants have suspended operation or cut production gradually from Jiangyin of Jiangsu, Sichuan and Chongqing to Wujiang, Yizheng and Hebei.

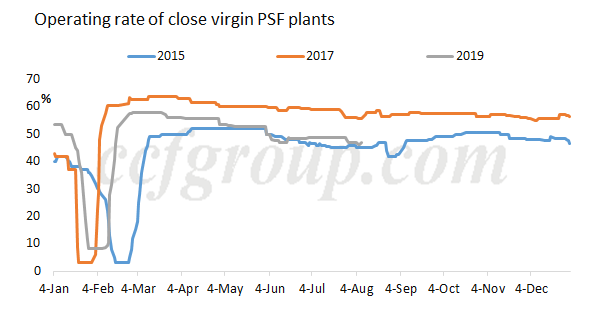

Looking from the operating rate of close virgin PSF plants from 2015, it is seen that operating rate this year is far lower than that in 2017, even close to the level in 2015. Looking back the history, in 2015, the market has been in downward trend in most of the time except Apr, and the capacity of solid re-PSF was idled, especially in the third quarter, virgin PSF prices kept downward dragged down polyester market. However, the feedstock supply was ample at that time, and close virgin PSF could keep a spread with virgin PSF.

But the situation is different this year, the pressure becomes larger.

Recently, PET flake prices are firm. After PFY plants cut production or suspend operation, the popcorn prices are hard to decrease. Currently, close virgin PSF is supported somewhat by the costs. This year, the close virgin PSF prices are in downward trend at the most of the time, and prices are the major factor to the sales.

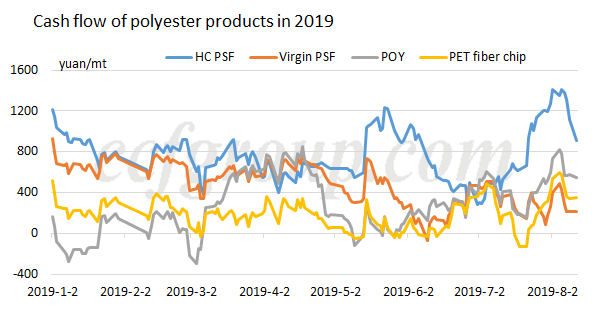

Cash flow of polyester products is above 400yuan/mt, and there is still downward space. Therefore, it is heard that some buyers in Fujian and Hebei turn to purchase virgin PSF. The market shares of close virgin PSF are squeezed by the virgin PSF.

In 2020, the new units of virgin PSF and recycled PSF will be put into operation intensively, and the competition will be fiercer.

|

|