|

|

|

home > Industry News

Polyester filament price ends falling and rallies with hot sales

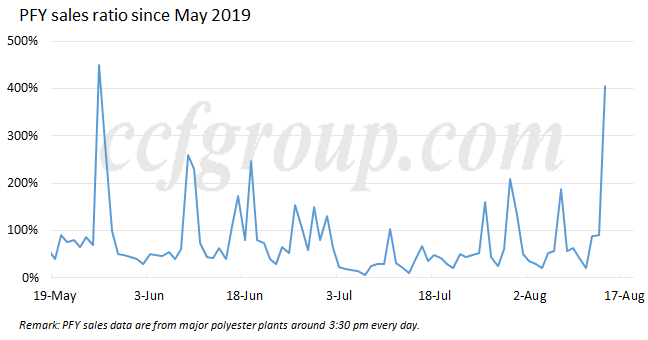

Affected by surging crude oil, price of polyester filament yarn increased by 50-150yuan/mt on Wednesday morning, and sales improved apparently, with sales ratio at around 270% by A.M.11:30. Some PFY plants suspended offering or raised price after sales increased, and the sales ratio was assessed at around 390% by P.M.3:30, the highest level since end-May.

Except for stimulus from crude oil market, hot sales of PFY on Wednesday were also impacted by other factors.

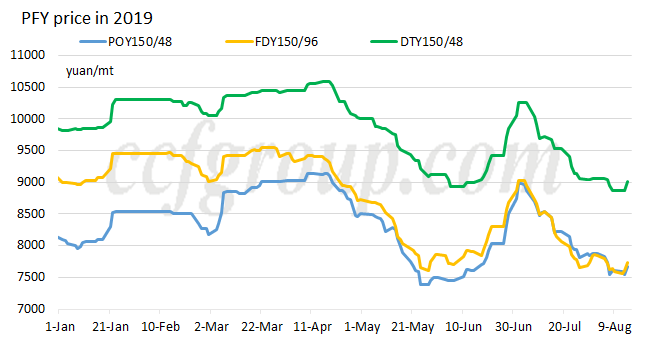

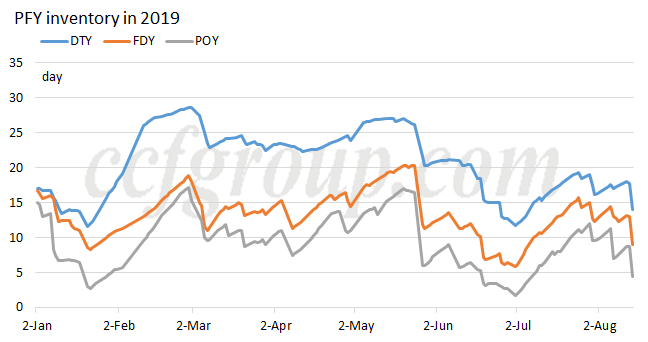

Firstly, downstream plants mainly used feedstock purchased before and kept the feedstock inventory at 5-10 days when PFY price was reducing. With low feedstock inventory, the downstream twisting and fabric mills had huge potential demand for raw materials. Secondly, price of FDY and DTY has touched yearly low, and that of POY was close to the low level in May. Price of PFY declined slowly in recent period. Meanwhile, PTA-PX spread has been narrowed to below 1,000yuan/mt, with limited downward space.

In addition, with the approach of traditional peak season "Golden September and Silver October", downstream players showed higher buying confidence, holding expectation toward peak-season demand. Some downstream buyers even worried supply shortage of PFY during the peak season as the stocks of finished goods were not high in PFY plants. By Wednesday, stocks of POY, FDY and DTY were around 4.5 days, 9 days and 14 days respectively.

This round of hot sales seemed to have some similarities with that in end-May: slanting low price, low feedstock inventory in downstream plants, and better anticipation toward demand. Will price of PFY rebound substantially like end-May?

Price of PFY hiked greatly from end-May to early-Jul mainly driven by feedstock market, particularly PTA. Price of PTA increased to above 6,800yuan/mt from 5,400yuan/mt, and the PTA-PX spread was as high as around 2,400yuan/mt, which is supposed to be constrained in the future in expectation of the startup of new PTA units.

Currently, stocks of grey fabric were slanting high, and grey fabric plants were keen sellers, but the operating rate of downstream plants may be hard to rise when new orders remained scarce and sales failed to improve, which will further impact their purchasing continuity and weigh on PFY price. Cash flow of POY and FDY was during positive territory now, especially POY. Taking 150D as an example, cash flow of POY was around 500yuan/mt, and profit of FDY was around 100-200yuan/mt. DTY plants were basically around cost line, indicating poor operation of PFY end-users.

Above all, hot sales of PFY are supposed to push up PFY price, but the rebounding range is expected to be smaller than that in end-May unless downstream demand will boom in later period.

|

|