According to the announcement released by National Development and Reform Commission and Ministry of Finance on Nov 22 2016, China state cotton auction would kick off from Mar 6, 2017 and tentatively end in end Aug, 2017. According to recent reserved cotton sales, most market players considered that the state cotton auction might extend, but no official news are seen by now.

If the state cotton auction is extended, it will pose large impact on cotton market. Some conjectures are made for the late state reserves sales based on current situation.

Trading prices and volumes of reserved cotton recently

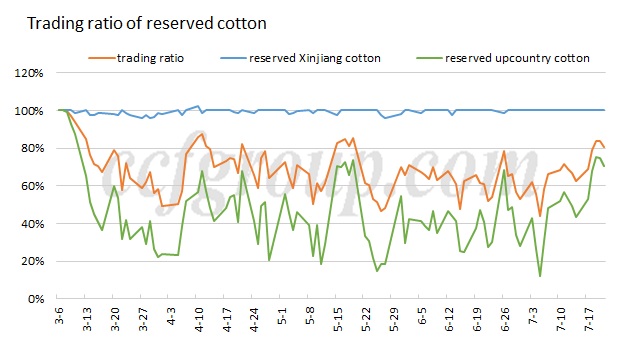

Recently, reserved Xinjiang cotton continued to be transacted at almost 100% per day, and trading ratio of reserved upcountry cotton kept up to 75% last week.

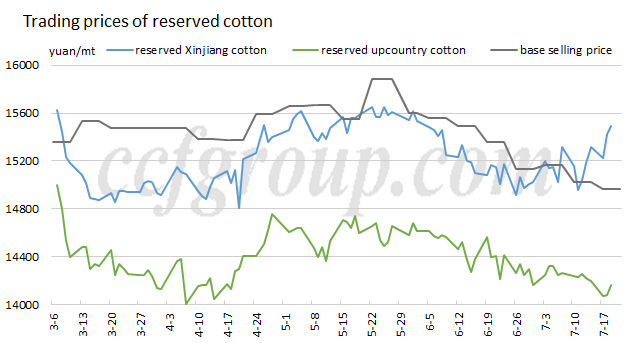

For trading prices, prices of reserved Xinjiang cotton moved up quickly as well, highly at 16,300-16,450yuan/mt, close to the 2016/17 cotton prices in physical market. But prices of reserved upcountry cotton prices decreased by about 500yuan/mt followed by the lower base selling prices. The higher trading volumes of upcountry cotton were partly because that mills and traders showed higher buying interests with the impending end of cotton auction, partly because that the prices of upcountry cotton have lowered to the level of buying intention.

Conjectures on late state cotton auction

As mills and traders anticipate that the state reserves sales would end in end Aug previously, they began to be active to purchase reserved cotton and the auction might be quite active in Aug. However, if the cotton auction is prolonged, the available sources increase for buyers and trading ratio of upcountry cotton then may slip down. Besides, the cotton prices may weaken under the pressure.

In addition, the base selling price of reserved cotton is predicted to see large fall in the second week of Aug, as Cotlook A Index will face update to the Cotlook Forward A Index from the new crop international year. Currently, Cotlook Forward A Index was lower about 5.5cent/lb than Cotlook A Index, so according to our calculation, the base selling price of reserved cotton in the week from Aug 7 may decrease by 465yuan/mt.

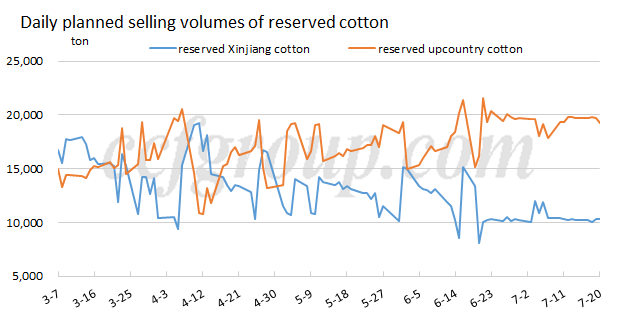

The sharp decrease of floor bidding price mainly influences the upcountry cotton. After its prices move lower further, its price performance will be more attractive to buyers. And for reserved Xinjiang cotton, the major influence is the planned selling volumes. Looking from the supply structure of reserved cotton recently, the selling volumes are quite steady. If the auction is prolonged, Xinjiang cotton may continue to be transacted well, but the increasing supply may ease the hot situation recently.

Conclusion

In general, market price is likely to slip if state cotton auction is confirmed to extend. Reserved Xinjiang cotton sales will maintain good, and the hot situation of high prices may ease somewhat. For upcountry cotton, sales may fall down in short term. From Aug 7, the floor bidding price of reserved cotton will see large fall followed by lower Cotlook A Index, then trading ratio of upcountry cotton may increase with higher price performance and prices may maintain at a reasonable range.