|

|

|

home > Industry News

Uzbekistani cotton imports of China likely to edge up in 2017/18

Import volumes of Uzbekistani cotton in China continued to move lower over the past few years, especially in 2016, the imports decreased sharply. The decrease was mainly attributed to the tight allocation of cotton quotas in China and the adjustment of textile and cotton export policies of Uzbekistan. Viewed from the supply and demand of Uzbekistani cotton in 2017/18, under the stable policy, China’s imports from Uzbekistan may stop falling or edge up.

Uzbekistan is the fourth largest cotton import origins for China and yearly import volumes are about 300kt in previous years, and in 2016, the volumes declined to 93kt. In the first eight months of 2016/17 season (from Sep 2016 to Apr 2017), China imported 66.6kt of Uzbekistani cotton, a fall of 45.3% on the year, and the proportion moved down from 18.9% to 8.5%. In the first four months of 2017, imports of Uzbekistani cotton approached 60kt, down 17.5% year on year.

The sharp decline of Uzbekistani cotton imports was partly because of tighter allocation of cotton quotas in China, partly because of the adjustment of textile and cotton export policies in Uzbekistan. Then, what about the imports of Uzbekistani cotton later? The insight will analyze from supply and demand, export and policy of Uzbekistani cotton.

Supply and demand of Uzbekistani cotton

Uzbekistan is the global seventh largest cotton producer, taking a share of about 60% in Central Asia. For China, above 95% of cotton in Central Asia is from Uzbekistan, only with modest quantity from Turkmenistan and Tajikistan.

| Uzbekistani cotton supply and demand forecast by USDA |

| |

areas (1,000 hectares) |

yeild (KG/HA) |

output (KT) |

consumption (KT) |

export (KT) |

beginning stock (KT) |

ending stock (KT) |

| 2011/12 |

1350 |

645 |

870.9 |

293.9 |

544.3 |

271.7 |

304.4 |

| 2012/13 |

1350 |

742 |

1001.5 |

315.7 |

696.7 |

304.4 |

293.5 |

| 2013/14 |

1300 |

687 |

892.7 |

326.6 |

587.9 |

293.5 |

271.7 |

| 2014/15 |

1285 |

661 |

849.1 |

337.5 |

533.4 |

271.7 |

249.9 |

| 2015/16 |

1285 |

644 |

827.3 |

348.4 |

544.3 |

249.9 |

184.6 |

| 2016/17 |

1180 |

669 |

789.2 |

370.1 |

326.6 |

184.6 |

277.2 |

| 2017/18 |

1180 |

683 |

805.6 |

381 |

370.1 |

277.2 |

331.6 |

Several features of cotton supply and demand in Uzbekistan: consumption continued to increase, while output reduced gradually, leading to the decrease of cotton exports, especially in 2016/17 season.

Firstly, domestic cotton consumption: textile industry is an important industry for Uzbekistan’s economy and export earnings and the government puts many efforts on supporting the textile industry development. Uzbekistan has more than 900 textile enterprises and 1,000 garment processing enterprises and every year, tens of new textiles and garment processing enterprises will be set up, which will keep for next five years. Therefore, cotton consumption in Uzbekistan tends to rise steadily.

According to the government, the regions with low cotton yields will be changed to plant other crops, like fruits and vegetables, so till 2020, cotton areas are predicted to keep reducing. Due to lower cotton areas and slight change of yields, cotton output also moved downward in recent years.

Therefore, cotton export volumes of Uzbekistan kept downward. In 2016, only one enterprise in Uzbekistan could purchase cotton and the exports of cotton decreased sharply. The government tends t promote the development of cotton yarn and downstream industries.

In 2017/18 season, output, consumption and export is projected to inch up and ending stocks are also estimated to increase.

Major cotton export destinations of Uzbekistan

The major cotton export destinations are China, Bangladesh and Turkey, with a total share of two thirds.

During 2012 and 2015, exports to China reduced sharply due to tighter allocation of quotas and more cotton flowed to Bangladesh. In 2016, exports to China reduced nearly 50%. Exports to Turkey were small, but kept growing.

| Import volumes of Uzbekistani cotton (Unit: KT) |

| |

China |

Bangladesh |

Turkey |

| 2012 |

309.8 |

137.8 |

8.8 |

| 2013 |

273.5 |

126.8 |

8.5 |

| 2014 |

170.5 |

157 |

8.7 |

| 2015 |

171.5 |

145.4 |

9.6 |

| 2016 |

93.1 |

/ |

13.7 |

Status quo of imported Uzbekistani cotton in China

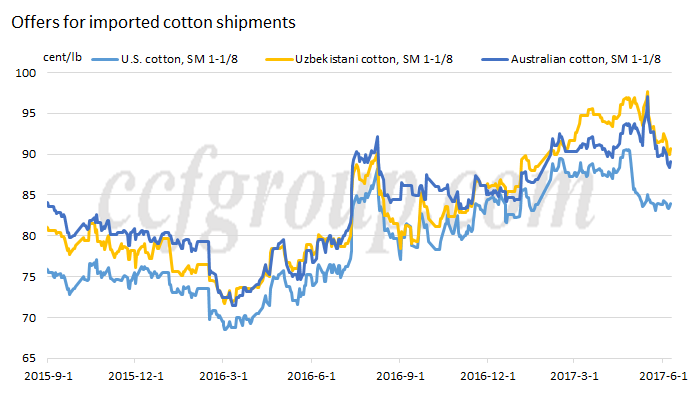

The quality of Uzbekistani cotton is inferior compared to U.S. and Australian cotton due to trash content and large micronaire. The offers for Uzbekistani cotton shipments are basically between the level of U.S. and Australian cotton. Due to limited available export volumes of Uzbekistani cotton, its prices were basically flat compared to that of Australian cotton in the first half year of 2016, and then the prices fell down somewhat in the second half year, and exceeded in early 2017. Currently, the mainstream level of offers for Uzbekistani cotton, SM 1-5/32, was nearly 90cent/lb, close to the level of Australian cotton shipments, but higher about 3cent/lb compared to the U.S. cotton. Cleared Uzbekistani cotton, SM 1-5/32, was offered at 16,850yuan/mt, cleared U.S. cotton, SM 1-5/32, at 17,600yuan/mt, cleared Australian cotton, SM 1-5/32 at 18,400yuan/mt.

In China, there are certain quantity of quotas is directed to clear Central Asian cotton and the prices are lower than the other ordinary trade quotas. Currently, the prices of ordinary trade quotas for cotton were pegged at 2,400yuan/mt, amid tight supply, while for the directed quotas for Central Asian cotton, the supply was ample, which led to the difference on the clearance costs. Therefore, sales of Uzbekistani cotton were favorable on Chinese market.

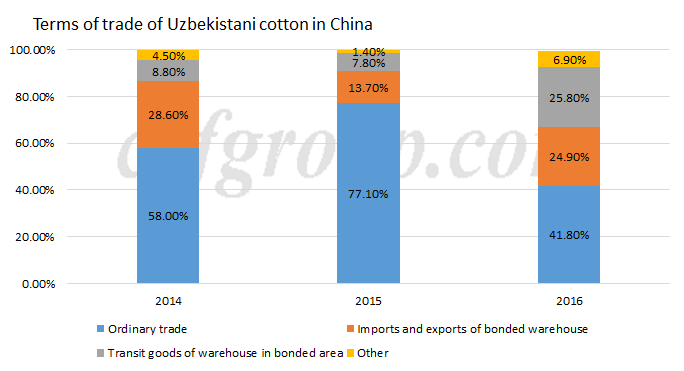

According to the China Customs, the terms of trade of Uzbekistani cotton in China changed much in recent three years. Ordinary trade accounted for the largest proportion, reaching the highest of 77.1% in 2015, while in 2016, the proportion decreased much.

Conclusion

China’s Uzbekistani cotton import volumes reduce sharply in 2016, not because of the reduction of consumption, but because of the decline of cotton exports in Uzbekistan. If cotton exports of Uzbekistani cotton will move up in 2017/18 season, then as the largest export destination, China will import slightly more Uzbekistani cotton. Besides, in the first four months of 2017, China has totally imported 478.9kt of cotton, an increase of 71.37% year on year and the imports of cotton are likely to grow in 2017. Later, the supply of quotas for cotton is supposed to remain tight, leading to firm prices, supportive to the cleared foreign cotton market.

|

|