With the approaching of New Year's Day holiday and Spring Festival holiday, holiday mood turned gradually stronger. Some warp knitting plants in Changshu reflected that the operating rate has declined to 30%.

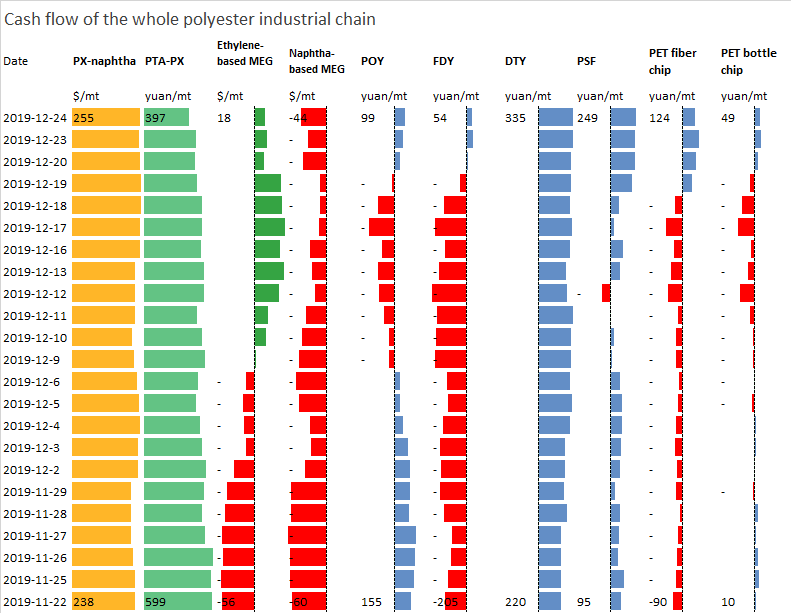

Feedstock market climbed up strongly in Dec, adding heat to polyester market. Spot and futures MEG basis surged to 1,000yuan/mt and gradually declined in recent days. Price of PTA also firmed up supported by strong cost side. Some traders were impacted by this round of big volatility and cash flow was squeezed in some plants.

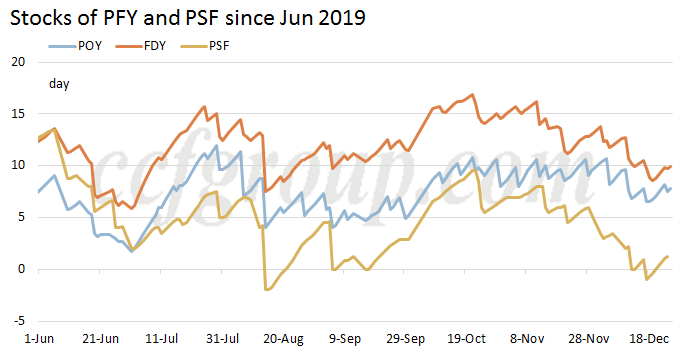

This round of fluctuation actually played positive role on polyester market, such as the switch of downturn expectation, falling polyester stocks and the placement of orders in some downstream market. Market players showed improving mindset. The cooperation of macro environment also exerted some effect.

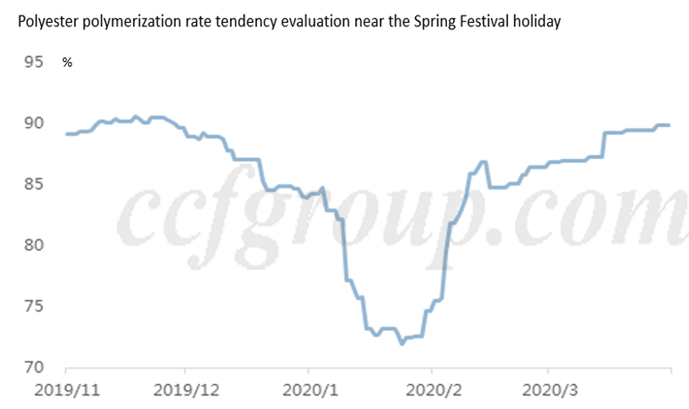

Operating rate of the whole industrial chain tends to reduce for holiday. Many polyester plants have confirmed the turnaround plan at the end of year, and the scale is not small. However, the specific time for shutdown and restart has not been completely confirmed in some companies, and the operating rate evaluation is under adjustment. According to the current situation, the short-run polyester polymerization rate tendency may be as following:

Some companies are still likely to adjust sequent operation. For example, the turnaround may be delayed when stocks of polyester products are slanting low and the cash flow of polyester goods restores again. As for the market status on downstream market, market participants did not show too pessimistic view, and most were rational.

Generally, the lowest polyester polymerization rate is expected to be near 72% near the Spring Festival holiday, which may appear in the second half of Jan. The comprehensive run rate of polyester market in Jan is estimated at around 77-79% and is likely to rise moderately in Feb, depending on the resuming time of the units and having variation.