On the 2018 China Cotton Industry Development Summit held in the northern city of Harbin, relevant department has revealed that 1.00 million tons of cotton quotas would be issued recently, and the quotas will continue to increase in 2019. The sliding-scale duty quotas will be released to the textile mills, while for processing trade quotas, mills need to apply for it. Though the specific releasing time has not been said, the news has been bullish for international cotton market, as the global market cannot fulfill the demand of 1.00 million tons. The planting in North Hemisphere has basically completed. And for 2018/19 season, will the international market can fulfill the additional demand from Chinese market? How will the market fare?

1. Market dynamics led by Chinese policies

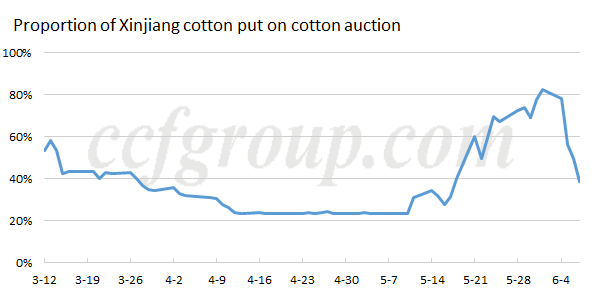

On June 2, the China National Cotton Reserves Limited and the China National Cotton Exchange released that non-textile mills were not allowed to take part in the cotton auction from June 4 to the end of the cotton auction (which is scheduled to end on Aug 31, 2018). Then according to the news from China Cotton Association, China would issue additional cotton quotas. The two pieces of news gave the market bearish signal. The selling volumes of reserved Xinjiang cotton have risen before June 4, leaving an expectation of ample Xinjiang cotton, slowing down the mills’ tempo to procure cotton. Meanwhile, the quota policy will increase the cotton supply. It was good news for domestic textile mills and it is also likely to squeeze the market shares of domestic cotton. Besides, the news affected the cotton futures and during June 4-6, ZCE cotton futures market slumped.

Nevertheless, after June 4, the selling volumes of reserved Xinjiang cotton have declined quickly and the quality was also unfavorable. In the meantime, 2018 China Cotton Industry Development Summit held on June 7 revealed that China would release additional 1.00 million tons of cotton quotas. If the foreign cotton can be imported on that volumes, it will depress the domestic cotton prices indeed. But the cotton will be purchased from international cotton market. Whether the international cotton market can provide such large volumes of foreign cotton to China?

2. International cotton market supply tightens gradually

The detailed information about the additional import quotas has not revealed. If the cotton quotas are requested to be used before end Dec of this year, then what cotton can be supplied?

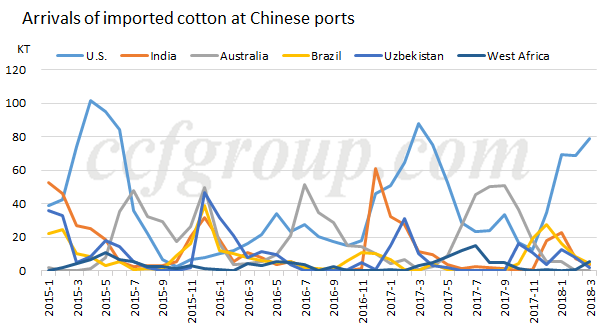

During Jun and Dec, the cotton that will be arrived at Chinese ports is Australian and West African cotton (Jun-Oct), Brazilian cotton (Oct-Dec) and Central Asian and Indian cotton (Nov-Dec). Except Australian and Brazilian cotton, which is on arriving period, there may be outstanding orders to be concluded, for Indian, West African and Central Asian cotton, the sources have been signed contracts mostly, let alone the quality sources.

Of course, in the USDA May supply and demand report, the ending stocks outside China in 2017/18 are supposed to rise 1.90 million tons (the increasing volumes in U.S., India and Brazilian cotton are 1.00 million tons), but the quality of remnant 2017/18 U.S. and Indian cotton is a problem. As the Indian cotton has no quality advantage compared with China’s Xinjiang cotton, with no obvious price edge, China reduces the imports of Indian cotton. For U.S. cotton, it is oversold. By May 31, sales of 2018/19 cotton have reached 1.06 million tons, about one third of the forecast exports. But there are more than 0.40 million tons of 2017/18 cotton left, the quality is considered to be not good.

Therefore, international cotton supply in circulation tends to be tight in 2017/18 season.

In Jun, the cotton crop sowing is virtually complete in North Hemisphere. Even cotton prices move up currently and profits increase, the plantings have ended mostly and the planting areas are not likely to change. Since May, the weather in Asia and U.S. is not favorable to the growing of cotton crops. The three largest cotton producers, China, India and U.S., estimate that the cotton output may decrease in 2018/19 season. The supply is likely to be relatively tight in 2018/19 season. International cotton prices are likely to maintain high, or even increase, leading to higher international cotton prices than domestic prices.

3. International cotton prices and domestic prices

In fact, according to the USD offers of foreign cotton on Jun 8, part of imported cotton prices has been higher than domestic prices. Calculated with the 5% of the lowest sliding-scale duty, except Indian and Pima, the prices left are higher than domestic prices. Therefore, even the textile mills have quotas at hand, there is no suitable sources to be cleared, which may push up domestic cotton prices.

| Origins |

Varieties |

Offers (cent/lb) |

Cleared prices under 1% tariff (yuan/mt) |

Cleared prices under 5% tariff (yuan/mt) |

shipment month |

| U.S. |

EMOT SM 1-5/32 |

105.95 |

16825 |

17484 |

Jun/Jul |

| U.S. |

C/A SM 1-1/8 |

107.98 |

17143 |

17814 |

Jun/Jul |

| Australia |

SM 1-5/32 |

108.4 |

17210 |

17883 |

Jun/Sep |

| Brazil |

M 1-1/8 |

103.3 |

16409 |

17051 |

Aug/Sep |

| India |

S-6 1-5/32 |

98.67 |

15682 |

16295 |

Jun/Jul |

| Central Asia |

SM 1-5/32 |

110.75 |

17578 |

18267 |

Jun/Jul |

| West Africa |

BOLA/S 1-1/8 |

102.65 |

16307 |

16945 |

Jun/Jul |

| Mali |

Juli/S 1-1/8 |

105.63 |

16774 |

17431 |

Jun/Sep |

| Greece |

M 1-1/8 |

106.75 |

16951 |

17614 |

Nov/Dec |

| U.S. |

SJV GC 1-7/16 |

159.5 |

25228 |

26219 |

Jun/Jul |

4. Summary

China is likely to issue additional 1.00 million tons of cotton quotas this year, while the supply on international market is tight, so downstream mills may have no suitable sources to import and cannot use the quotas. Global and Chinese cotton prices are likely to increase. Pay attention to the China’s supply, one is the locked enormous on-call cotton, one is the uncertain reserved Xinjiang cotton volumes.